What Does Pacific Prime Do?

In the United States, wellness insurance coverage is a voluntary matter, yet lots of individuals are involuntarily without coverage. There is no assurance for a lot of people under the age of 65 that they will be eligible for or able to manage to buy or keep medical insurance. Nearly seven out of every ten Americans under age 65 years are covered by employment-based wellness insurance, either from their job or via a parent or partner.

A modification in insurance premium or terms, along with adjustments in earnings, health, marital status, terms of employment, or public plans, can activate a loss or gain of health and wellness insurance coverage. For regarding one-third of the without insurance populace, lacking coverage is a temporary or one-time disturbance of insurance coverage, and the median duration of a duration without insurance is in between 5 and 6 months.

Pacific Prime - An Overview

Since the mid-1970s, development in the expense of health insurance policy has outmatched the surge in genuine income, developing a gap in acquiring ability that has actually included about one million individuals to the rankings of the uninsured yearly. group insurance plans. Despite the economic prosperity of recent years, in between 1998 and 1999 there was only a slight drop in the numbers and proportion of without insurance Americans

Considering that the mid-1990s, increases in employment-based coverage have been offset by constant or decreasing prices of public and separately acquired protection. * Completely, about 83 percent of the nonelderly population is covered by employment-based, specific and public strategies. Some people report greater than one resource of protection over the training course of a year.

The clergy and other religious employees make up the largest single classification of people without connections to Social Security and Medicare. 3In 1996, the CPS quote of the variety of nonelderly individuals without insurance was 41 million (Fronstin, 2000a) (https://disqus.com/by/disqus_tLNq8V4sBK/about/).4 The federal Emergency situation Medical Treatment and Energetic Labor Act, part of the Consolidated Omnibus Budget Plan Reconciliation Act of 1985, needs medical facility emergency spaces to analyze and stabilize all individuals with a life- or limb-threatening or emergency situation clinical problem or those that are regarding to provide birth

Get This Report about Pacific Prime

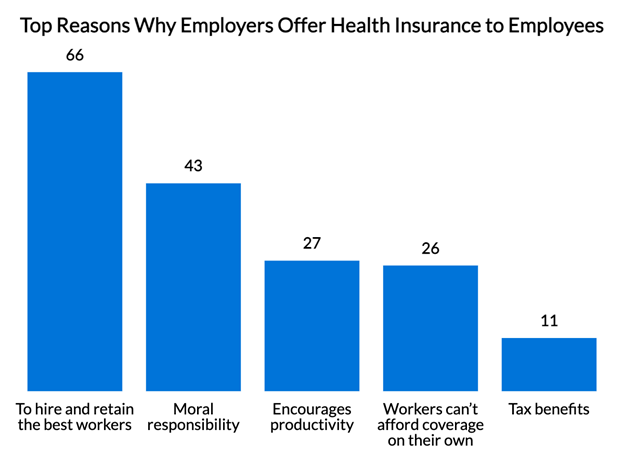

Insurance can be acquired from different resources. In many cases, you can get insurance protection via an employer. Employers typically use medical insurance, and occasionally life insurance policy and disability insurance coverage, as an office benefit. When you get insurance through a company, you may have a choice of several plans that your company has pre-selected and your company might pay some or every one of the costs for your insurance coverage.

Restricted insurance policy refers to a subsidiary corporation established to give insurance to the parent business and its affiliates. A captive insurance provider stands for an alternative for numerous corporations and teams that desire to take financial control and handle threats by underwriting their own insurance policy instead than paying premiums to third-party insurance companies.

6 Easy Facts About Pacific Prime Described

For several years currently, Vermont has rated as the number one hostage residence in the United States and in 2022 came to be the number one-ranked residence globally - https://allmyfaves.com/pacificpr1me?tab=pacificpr1me. Vermont's success to date can be credited to a mix of aspects, not the least of which is the ongoing management of Vermont's Governors, both past and existing, and both homes of the State Legislature that remain to maintain Vermont's next page historical practice of supplying solid support for this state's captive market

Lots of New Yorkers invest considerable amounts of money yearly on life insurance premiums with really little idea of what they are obtaining for their money - international travel insurance. Often customers do not realize that there are major differences in the sorts of life insurance coverage they can purchase and the resources for such insurance coverage